Forest fire crews deal with a few fires this week

Some forest fire activity in northwestern Ontario this week. Crews with the Ministry of Natural Resources and Forestry's Aviation, Forest Fire and Eme...

5h ago

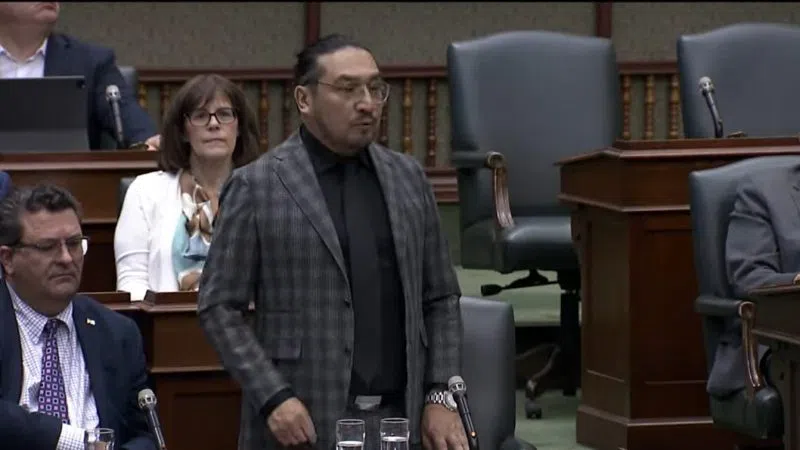

MPP questions consultation efforts with First Nations

The MPP for Kiiwetinoong is tempering the enthusiasm about new electric vehicle plants in southern Ontario. Honda is the latest to announce plans. Sol...

5h ago

Bicycle patrol coming to Dryden

Dryden residents can look forward to seeing a police officer on a bicycle this summer. The Ontario Provincial Police are launching a new bike patrol. ...

5h ago

Prospectors' Association hands out awards

The Northwestern Ontario Prospectors Association (NWOPA) is honouring some of its own. It handed out its annual awards during the Ontario Prospectors ...

7h ago

What's Happening on CKDR

Honoring Legendary Bob Cole

11h ago

"Check Out" Ontario Park Day Passes

Dryden Public Library, Ear Falls Public Library, Sioux Lookout Public Library, and Red Lake Public library are all listed as participants! Give your l...

Apr 16, 2024

Red Apple Is Back In Sioux Lookout!

Lots of excitement in Sioux Lookout this past weekend! In fact it began on Friday when Red Apple's Grand Reopening in Sioux Lookout at 81 Front Stree...

Apr 15, 2024

Get Ready To Laugh!

Need a few laughs? 'Campfire Comedy' can help! 'Campfire Comedy' presents 'The Mark Menei Comedy Tour' with shows coming to several communities aroun...

Apr 10, 2024